Insurance Planning

Insurance Planning

Insurance is the transfer of risk by an individual, such as yourself, or an organisation, such as your business, to the insurance company. You or your organisation will thus be known as the policy owner. The insurance company receives payment in the form of premium and will compensate you in the event of losses or damages sustained by you.

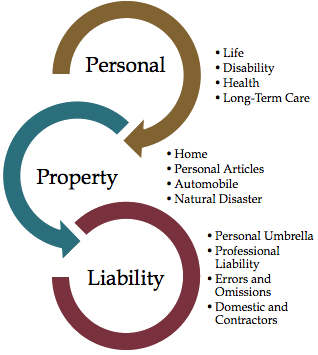

All too often we hear about various types of insurance policies without really understanding what they are and more importantly, what they protect. The truth is, there are two main types of insurance, namely life insurance and general insurance which covers different aspects in your life.

Types of Insurance

There are two broad types of insurance:

Types of Insurance

Life Insurance

General Insurance

Term Life

Money-back policy

Unit-Linked Insurance Plan

Pension Plans

Motor Insurance

Home Insurance

Health Insurance

Fire Insurance

What is Life Insurance

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of an insured person.

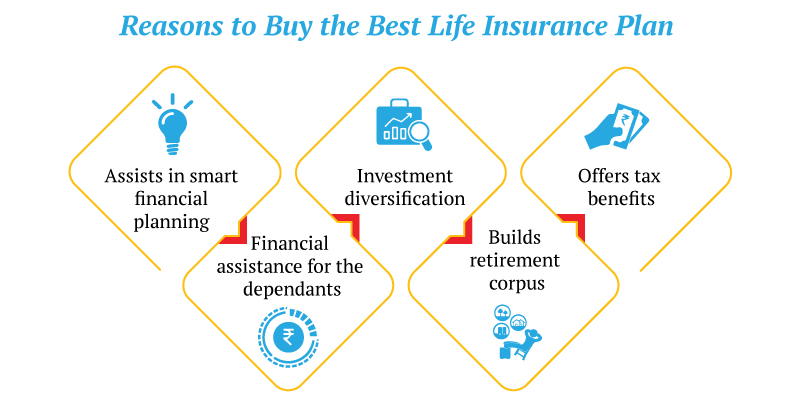

Life insurance can help you support your family even after retirement. Depending on what it covers, Life insurance can be classified into various types:

Term Insurance | – It is the most basic type of insurance. |

Whole Life Insurance | – It covers you for a lifetime. |

Endowment Policy | – Like a term policy, it is also valid for a certain period. |

Money-back Policy | – A certain percentage of the sum assured will be paid to you periodically throughout the term as survival benefit. |

Unit-linked Insurance Plans (ULIPs) | – Such products double up as investment tools. |

Child Plan | – This ensures your child’s financial security. |

Pension Plans | – This helps build your retirement fund. |